ajya.online

Tools

12 Month Interest Free Loan

Customizable loans. From $3, to $, and terms from 12 to 84 ajya.onlinete 4 ; Competitive rates. Fixed interest rates and an interest rate discount. Loans are interest-free, and you don't need to make payments. Repayment. Begins 12 months after you leave school. Interest is added to your loan balance monthly. Repay a personal loan in terms of months and with fixed rates ranging Consolidate higher-interest credit card and other debts3, and pay the balance off. Deferred payments - 3,6,9,12 months. *On approved credit. Depending on your credit profile, you. Lenders don't offer interest-free loans, but other types of interest-free credit are available. Below are four options you could consider. If you're struggling to meet the payments on an interest-free deal, contact the lender. You have the right to apply to the lender to make your loan more. Pay for your new Apple products over time, interest-free when you choose to check out with Apple Card Monthly Installments. **LIMITED TIME ONLY. No Interest if paid in full within 12, 18 or 24 Months. Offer applies to purchase or order of $–$ for 12 months offer; $ As its name suggests, a zero-interest loan is one where only the principal balance must be repaid, provided that the borrower honors the rigid deadline by which. Customizable loans. From $3, to $, and terms from 12 to 84 ajya.onlinete 4 ; Competitive rates. Fixed interest rates and an interest rate discount. Loans are interest-free, and you don't need to make payments. Repayment. Begins 12 months after you leave school. Interest is added to your loan balance monthly. Repay a personal loan in terms of months and with fixed rates ranging Consolidate higher-interest credit card and other debts3, and pay the balance off. Deferred payments - 3,6,9,12 months. *On approved credit. Depending on your credit profile, you. Lenders don't offer interest-free loans, but other types of interest-free credit are available. Below are four options you could consider. If you're struggling to meet the payments on an interest-free deal, contact the lender. You have the right to apply to the lender to make your loan more. Pay for your new Apple products over time, interest-free when you choose to check out with Apple Card Monthly Installments. **LIMITED TIME ONLY. No Interest if paid in full within 12, 18 or 24 Months. Offer applies to purchase or order of $–$ for 12 months offer; $ As its name suggests, a zero-interest loan is one where only the principal balance must be repaid, provided that the borrower honors the rigid deadline by which.

What you can count on from Discover · Great Rates. Save on interest with a fixed interest rate from % - % APR. · Flexible Terms. Borrow up to $40, and. ~ Up to 60 months Long Term Interest Free finance (LTIF) available only during the term of the promotional period offered, interest (at the Expired Promotional. You only pay interest on the funds you use, so you could have an open account with no interest if you have no balance. Unlike personal loans, where your monthly. Specialist interest-free credit cards are available that offer 0% interest for 12 to 24 months. These cards are generally used by people who have an existing. A no-interest loan allows you to make a major purchase right away, then pay for it interest-free over time. These loans are designed to entice customers to make. Valid 1/4//29/ **NO INTEREST IF PAID IN FULL WITHIN 12 MONTHS on Installed Window Purchases of $6, or More. Interest will be charged to your. If you spend on cards but don't repay in full, try a 0% credit card with up to 21 months' interest-free spending. Compare Martin Lewis' top pick comparison. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. An interest-only mortgage is a loan with monthly payments only on the interest of the amount borrowed for an initial term (typically seven to 10 years) at a. No Interest with Equal Monthly Payments for 88 Months On in-store Combinable with 12 month promotional financing only. Cannot be combined with. Some government funds offer interest-free loans. However, they usually have very stringent qualifying criteria, such as. Continue Reading. If you take out a personal loan, you'll typically make fixed monthly payments until the installment loan is paid in full — plus interest. But if you get an. may be required. Interest. Interest-free. 0–36% APR. Fees? Never. Never. Credit impact to apply? None. None. Credit impact with a loan? May impact if delinquent. This is frequently seen with 0% APR credit cards that offer financing interest-free for the first 12 or 24 months before they switch to charging you interest . Capital One Shopping is free for everyone whether or not you have a Capital One credit card. Looking for a card that could help you save money on interest. Pay for your new Apple products over time, interest-free when you choose to check out with Apple Card Monthly Installments. Terms Apply. Enjoy an additional month interest-only repayment grace period after the end of your study period on the principal amount borrowed. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. You're always free to make loan payments ahead, in part or in full. Minimum loan amount is $1, and loan terms range from 12 to 84 months (up to 60 months. Special financing offers: No interest if paid in full within 6, 12 or 24 months. Interest will be charged to your Special Financing-Enabled Card.

Who Gets The Interest On A 401k Loan

:max_bytes(150000):strip_icc()/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg)

To pay interest on a plan loan, you first need to earn money and pay income tax on those earnings. With what's left over after taxes, you pay the interest on. Get Help. Help for individuals · Find a financial professional. Your Interest rate lower than credit cards and most personal loans, including payday loans. For a (k) loan, any interest charged on the outstanding loan balance is repaid by the participant into the participant's own (k) account; technically. The good news is that the payment amounts and the interest go right back into your account. Get expert tips, strategies, news and everything else you. A (k) loan is an interest bearing loan on a participant's existing (k) balance. Get it on Google Play. Investing in securities involves a risk of. Employees who participate in the Texa$aver (k)/ Program may borrow a portion of your account balance in the form of a loan once you have an account. A loan that is in default is generally treated as a taxable distribution from the plan of the entire outstanding balance of the loan (a “deemed distribution”). When you borrow against your (k), you have to pay interest on your loan. The good news is that you'll be paying that interest to yourself. Your plan. Regulations from the Department of Labor require that (k) plan loans “bear a reasonable rate of interest.”2 While there's no set interest rate that plans. To pay interest on a plan loan, you first need to earn money and pay income tax on those earnings. With what's left over after taxes, you pay the interest on. Get Help. Help for individuals · Find a financial professional. Your Interest rate lower than credit cards and most personal loans, including payday loans. For a (k) loan, any interest charged on the outstanding loan balance is repaid by the participant into the participant's own (k) account; technically. The good news is that the payment amounts and the interest go right back into your account. Get expert tips, strategies, news and everything else you. A (k) loan is an interest bearing loan on a participant's existing (k) balance. Get it on Google Play. Investing in securities involves a risk of. Employees who participate in the Texa$aver (k)/ Program may borrow a portion of your account balance in the form of a loan once you have an account. A loan that is in default is generally treated as a taxable distribution from the plan of the entire outstanding balance of the loan (a “deemed distribution”). When you borrow against your (k), you have to pay interest on your loan. The good news is that you'll be paying that interest to yourself. Your plan. Regulations from the Department of Labor require that (k) plan loans “bear a reasonable rate of interest.”2 While there's no set interest rate that plans.

Interest rates are generally low (1 or 2 percent above the prime rate) and paperwork is minimal. But a (k) loan is just that—a loan. And it needs to be. Get a customizable, affordable (k) plan Unlike a (k) withdrawal, you won't have to pay taxes and penalties on your loan—and the interest you pay goes. Money withdrawn from your (k) account will not be earning interest, so your retirement savings might not grow at the same rate. Using a personal loan to. The reason is that a participant loan, at its core, is an exception to a rule. One of the main federal laws that govern retirement plans was put in place to. You need to pay back the money monthly with interest. The interest also goes to your account as basically you are borrowing money from yourself. You may borrow the lesser of 50% of your participant account value or $50, · The loan is for a 5-year maximum term. · The interest rate is set at prime +2%. Under federal tax law, no deduction is permitted for interest paid on a loan from the plan, regardless Where do I go to get a loan repayment estimate? You don't get the interest on the loan. You repay the principal but the interest goes to the company holding your retirement account. Upvote. Many (k) plans allow you to borrow from your account balance, letting you repay the loan through automatic, after-tax payroll deductions. Borrowing from your. What is a reasonable rate of interest for Solo k loans? As long as the Solo k loan interest rate is consistent with the interest rate charged by. What happens if you leave your job before the loan is paid off? Although you generally have up to five years to repay loans from your (k) plan account. The current prime rate is %, so your (k) loan rate would be from % to %. Your credit score doesn't affect the interest rate, which is one reason. You do. Well, the future you gets to keep the interest you pay on your (k) loan. While the IRS sets the loan limits, repayment. What rate of return do you expect to earn from your (k) investments? What interest rate will you pay on your loan? How long will. While you'll pay interest similar to a more traditional loan, the interest payments go back into your account, so you'll be paying interest to yourself. You can. With most loans, you borrow money from a lender with the agreement that you will pay back the funds, usually with interest, over a certain period. With (k). A (k) loan will generally be better than taking a loan with a third party—even a home equity line of credit—in that you're paying the (k) loan interest. Many borrowers use money from their (k) to pay off credit cards, car loans and other high-interest consumer loans. On paper, this is a good decision. The Usually when you're earning interest/growth, it is coming from someone else. When you deposit money in the bank, you are getting interest from. For Collateralized Loans, does the amount held as collateral continue to earn interest while the loan is outstanding?

Visa 0 Interest Balance Transfer

Annual fee · 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. Can I use a Visa balance transfer for items other than credit card or loan debt? Yes. In addition to paying off existing debt, you can use a Visa balance. Wells Fargo Reflect® Card · · 0% intro APR for 21 months from account opening on qualifying balance transfers ; Blue Cash Everyday® Card from. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility. However. Let's face it: no one likes having debt, especially debt with high interest. Take it down a notch and no transfer fees! Apply for a Visa® Balance Transfer. A balance transfer lets you move debt from one or more accounts to another. Transferring high-interest debt to a credit card with a low or 0% introductory APR. The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. A 0% APR balance transfer is a great way to pay down the principal on your credit card debt, saving you hundreds of dollars in interest. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently. Annual fee · 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. Can I use a Visa balance transfer for items other than credit card or loan debt? Yes. In addition to paying off existing debt, you can use a Visa balance. Wells Fargo Reflect® Card · · 0% intro APR for 21 months from account opening on qualifying balance transfers ; Blue Cash Everyday® Card from. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility. However. Let's face it: no one likes having debt, especially debt with high interest. Take it down a notch and no transfer fees! Apply for a Visa® Balance Transfer. A balance transfer lets you move debt from one or more accounts to another. Transferring high-interest debt to a credit card with a low or 0% introductory APR. The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. A 0% APR balance transfer is a great way to pay down the principal on your credit card debt, saving you hundreds of dollars in interest. For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently.

BECU offers a low-rate and a Cash Back credit card that offers % cash back on every purchase. BECU also offers affinity card designs. When you transfer your balance to Visa Rewards Plus, you won't pay any balance transfer fee and won't pay any interest on that balance for an entire year! Save money by transferring high-interest debt to a balance transfer card. Get matched to credit cards from our partners based on your unique credit profile. There is a balance transfer fee of either $ or 2% of the amount of each transfer, whichever is greater. Balance transfers from other Provident Credit Union. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. Save on interest with a low intro APR for 18 months Purchases and balance transfers are interest free with 0% intro APR for 18 months from account opening. Once your balance transfer is complete, you'll see the requested amount added immediately to the balance of your DCU Visa account. This will show up as a Cash. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money. The 0% rate is usually valid for 12 or 18 months, sometimes more. Can you pay off the transferred balance during that period? If not, what interest rate kicks. Enjoy 0% intro APR on balance transfers for the first 18 billing cycles after account opening with a TD FlexPay Credit Card. Unlock the features of your new. 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, a variable APR of Min. of (+) and. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. 0% Intro APR for 21 months on balance transfers from date of first transfer; after that, the variable APR will be % - %, based on your. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. A credit card balance transfer can be a wise decision if you're looking for a way to lower your monthly payment or interest rate. Our Visa cards offer low APRs. Save on interest 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After. Enjoy our free balance transfer credit card deal to pay off your high-interest debt. Our credit card offers low, fixed rates and no balance transfer fees. If you have a 0% introductory or promotional APR balance transfer and also use your Account to make Purchases, you can avoid paying interest if you pay the “. If you transfer a balance from a high-interest credit card to a Discover Card with an introductory 0% APR balance transfer offer, you can use the money you save.

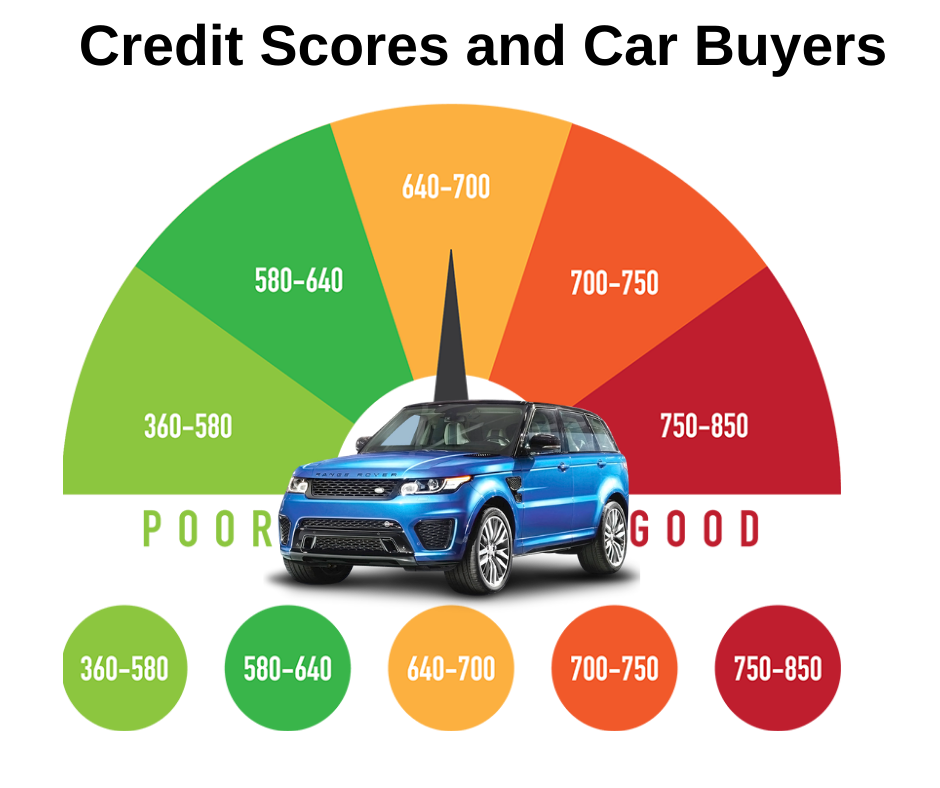

What Credit Score To Buy A Car

.png)

Buy versus Lease · How to pick a car? You might also have luck in the r/whatcarshouldibuy subreddit. Also remember to add flair to. To increase your chances of securing a car loan with reasonable rates and terms, it's advisable to aim for a credit score of at least or higher. A score in. The ideal credit score to secure favorable financing for a car typically starts around or higher. However, specific requirements can vary. In general, most lenders require a credit score of at least to qualify for a traditional car loan. Every borrower falls into a specific credit score. Non-prime: to ; Subprime: to ; Deep Subprime: to How to Get Car Financing With Bad Credit. Even if you don'. The higher your credit score, the lower interest rate you can expect to get on your car next car loan. Though this number can vary, you should aim to have a. As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. With that said, many Valrico shoppers are able. VantageScore considers a good credit range of around , while a good FICO score range is Dealers may pull from either score, but the FICO. Yes, it can—but only in certain cases. According to Equifax, when you co-sign for a loan, it is included in your credit history and is incorporated into your. Buy versus Lease · How to pick a car? You might also have luck in the r/whatcarshouldibuy subreddit. Also remember to add flair to. To increase your chances of securing a car loan with reasonable rates and terms, it's advisable to aim for a credit score of at least or higher. A score in. The ideal credit score to secure favorable financing for a car typically starts around or higher. However, specific requirements can vary. In general, most lenders require a credit score of at least to qualify for a traditional car loan. Every borrower falls into a specific credit score. Non-prime: to ; Subprime: to ; Deep Subprime: to How to Get Car Financing With Bad Credit. Even if you don'. The higher your credit score, the lower interest rate you can expect to get on your car next car loan. Though this number can vary, you should aim to have a. As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. With that said, many Valrico shoppers are able. VantageScore considers a good credit range of around , while a good FICO score range is Dealers may pull from either score, but the FICO. Yes, it can—but only in certain cases. According to Equifax, when you co-sign for a loan, it is included in your credit history and is incorporated into your.

So, how much credit do you need for a car loan? The fact is, just about any Sevierville driver can get an auto loan, regardless of their credit score. Why? To recap, the minimum credit score for a car loan approval is around You'll get better loan terms though if your credit score is anywhere between to. What's the Average Credit Score to Finance a Car? · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime. Average Credit Score For a New Car · Superprime ( to ): Drivers in this category can expect to get approved easily with the best interest rates possible. You don't need a specific credit score to buy a car, but higher scores mean lower interest rates. Navy Federal Credit Union explains how to get a lower. What Is the Average Credit Score? · Superprime: – · Prime: – · Non-prime: – · Subprime: – · Deep Subprime: – Auto Loan Tiers Based on Credit Scores · Super Prime rates are reserved for those with credit scores between · Prime rates are for those with a FICO. What credit score is needed to finance a car? There's no magic number, but higher credit scores are seen more favorably than lower credit scores by lenders. In , the average credit score for a new car loan was and the average credit score for a used car loan was But if you're looking for bad credit car. Deep Subprime: to How to Get Car Financing With Bad Credit. How do drivers in Villa Rica get a car loan if they have bad credit? For those. Lenders look at individuals with high credit scores as a low-risk of defaulting on payments, and will offer lower interest rates as a reward for good credit. Credit Score to Finance a Car: What to Expect · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to Most people and most credit scores — good or poor — can get one. The catch is that, as a rule, a lower score means paying a higher interest rate for the loan. You might not have the same options, but you can still get an auto loan with a credit score. purchase your car. Your lender will be cautious of. Average Credit Score to Finance a Car. The target credit score for securing a car loan is or above. · How to Get Car Financing With Bad Credit · Learn More. A will get you the best interest rate for a vehicle and if you don't like their rate then tell them it's too high and they should go back. What's the Average Credit Score to Finance a Car? The average credit score of drivers who have been approved for auto loans in is for a new vehicle and. The recommended credit score needed to buy a car is and above. This will typically guarantee interest rates under 6 percent. The information provided on. Generally speaking, the average credit score to finance a car is for a new vehicle and for a used vehicle. It's very possible to buy a car with bad. What Credit Score Do I Need To Buy a Car? Your best odds of securing a conventional car loan are with a credit score of over However, if your score is.

Air Travel Card

A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. The best free flight credit card is the Chase Sapphire Preferred® Card because it gives new cardholders 60, points, and those points are worth $ in. The best airline credit card is one you can actually use, so start with the airlines that serve your community, then focus on rewards and perks. Each Mile is equal to $ Miles cannot be redeemed directly with a specific airline carrier. Travel Purchases include airline tickets, hotel rooms, car. Enhance your travel experience with a Citi travel rewards credit card. Compare a variety of hotel and airline rewards, and choose the card that fits your. The Chase Sapphire Preferred® Card is the best credit card for earning rewards on any airline. It offers an initial bonuses on the market right now, allowing. Choose the best airline credit card for your travel needs to earn bonus miles and points toward free flights, and access other travel benefits. The Delta SkyMiles® Reserve American Express Card is the best airline credit card, thanks to its strong earning power, generous travel benefits and valuable. Apply for one of our travel credit cards and partner airline rewards credit cards to begin earning travel rewards that are simple to earn and redeem. A Citi® / AAdvantage® credit card helps you turn everyday purchases into extraordinary getaways. Start earning miles and Loyalty Points today. The best free flight credit card is the Chase Sapphire Preferred® Card because it gives new cardholders 60, points, and those points are worth $ in. The best airline credit card is one you can actually use, so start with the airlines that serve your community, then focus on rewards and perks. Each Mile is equal to $ Miles cannot be redeemed directly with a specific airline carrier. Travel Purchases include airline tickets, hotel rooms, car. Enhance your travel experience with a Citi travel rewards credit card. Compare a variety of hotel and airline rewards, and choose the card that fits your. The Chase Sapphire Preferred® Card is the best credit card for earning rewards on any airline. It offers an initial bonuses on the market right now, allowing. Choose the best airline credit card for your travel needs to earn bonus miles and points toward free flights, and access other travel benefits. The Delta SkyMiles® Reserve American Express Card is the best airline credit card, thanks to its strong earning power, generous travel benefits and valuable. Apply for one of our travel credit cards and partner airline rewards credit cards to begin earning travel rewards that are simple to earn and redeem.

Enhance your travel experience with a Citi travel rewards credit card. Compare a variety of hotel and airline rewards, and choose the card that fits your. For general-purpose travel, the Chase Ultimate Rewards cards (mainly the Sapphire Preferred and Reserve) are often recommended by users, but the. How to make the most of your travel cards. Woman booking flight tickets on airline website online with smartphone and making payment with credit card. What's. The Delta SkyMiles® Reserve American Express Card is the best airline credit card, thanks to its strong earning power, generous travel benefits and valuable. Offers a flat-rate redemption value of % for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. If you frequently fly with the same airline, using the right credit card can earn you increased rewards and special perks when you travel. After all, loyalty. These 7 airlines offer 'all you can fly' flight passes and packages — here's what you need to know · Alaska Airlines Flight Pass · Frontier Airlines GoWild! Pass. Earn rewards on airfare and travel with an airline card. Get matched to credit cards from our partners based on your unique credit profile. You can use your travel rewards credit card to book any airline, anytime, anywhere with no seat restrictions or blackout dates. You can also redeem your travel. Redeem miles for cash back, gift cards, hotel stays, airline tickets, and merchandise. Features. Explore travel credit cards from Wells Fargo. Review the travel reward benefits that fit your lifestyle. Find the best travel card for you and apply today. Airline credit cards feature rewards and perks you can use when you fly, whether with one airline or a selection of airline partners. Our payments ecosystem was purpose-built to simplify payments in complex industries, like the airline and travel industry. Our team of experts invest in. Plus, make the most of your journey with travel benefits and more. Learn more at ajya.online Terms Apply. Earn More With Amex Offers. Amex Offers helps Card. A general travel rewards card may give you the flexibility to earn rewards from a variety of airlines, not to mention other travel-related purchases. Each Mile is equal to $ Miles cannot be redeemed directly with a specific airline carrier. Travel Purchases include airline tickets, hotel rooms, car. View Citi® / AAdvantage® Credit Card offers. Our American Airlines travel credit card benefits include bonus miles and many other rewards. Learn more. $ United® travel credit after 7 United flight purchases of $ or more each anniversary year. Member FDIC. More card details. Recommended credit score. Get United Personal Credit Cards and earn miles and travel rewards with United Airlines flight credits – terms apply. Up to 6, Premier qualifying points. credit card all rolled in to one. You can also redeem points earned by Chase Sapphire to book any type of travel through the Chase Travel Portal, meaning you.

Companies That Accept Bit Coin

Microsoft is one of the top companies that accept bitcoin as payment, along with a few other cryptocurrencies, through BitPay. A: While it is difficult to get an accurate global total, around 30, merchants worldwide currently accept Bitcoin. Well-known brands include. 23 online stores that accept Bitcoin · Overstock was one of the first online stores to accept Bitcoin. · Microsoft has been accepting Bitcoin as payment since. Should your restaurant accept bitcoin? · Lower transaction fees. Merchant service providers charge up to 4% per transaction – or even more if your diner is from. Stores That Accept Bitcoin and Cryptocurrency · Magento · ajya.online · eGifter · Shopify · WooCommerce · BigCommerce. Holding bitcoins in a bitcoin wallet accept unlimited contributions from individuals, corporations, labor organizations and other political committees. Why consider using crypto? Roughly 2, US businesses accept bitcoin, according to one estimate from late , and that doesn't include bitcoin ATMs 1. An. accept Bitcoin. We're located in the growing high-tech sector of Downtown Or, you could shop at places that use a bitcoin transaction software like BitPay. Buy real estate with crypto. Find real estate companies that accept Bitcoin and cryptocurrency. Pay for real estate straight from your wallet. Microsoft is one of the top companies that accept bitcoin as payment, along with a few other cryptocurrencies, through BitPay. A: While it is difficult to get an accurate global total, around 30, merchants worldwide currently accept Bitcoin. Well-known brands include. 23 online stores that accept Bitcoin · Overstock was one of the first online stores to accept Bitcoin. · Microsoft has been accepting Bitcoin as payment since. Should your restaurant accept bitcoin? · Lower transaction fees. Merchant service providers charge up to 4% per transaction – or even more if your diner is from. Stores That Accept Bitcoin and Cryptocurrency · Magento · ajya.online · eGifter · Shopify · WooCommerce · BigCommerce. Holding bitcoins in a bitcoin wallet accept unlimited contributions from individuals, corporations, labor organizations and other political committees. Why consider using crypto? Roughly 2, US businesses accept bitcoin, according to one estimate from late , and that doesn't include bitcoin ATMs 1. An. accept Bitcoin. We're located in the growing high-tech sector of Downtown Or, you could shop at places that use a bitcoin transaction software like BitPay. Buy real estate with crypto. Find real estate companies that accept Bitcoin and cryptocurrency. Pay for real estate straight from your wallet.

NOWPayments is a cryptocurrency payment gateway for accepting Bitcoin, Ethereum, stablecoins and over other cryptos. Sign up for free and start. If you want to find stores near you that work with Bitcoin, use Coinmap It shows the merchants that accept BTC on a local map. Bitcoin is Accepted at REEDS Jewelers You can use bitcoin to buy fine jewelry and watches, ranging from engagement rings to Pandora charms, in all REEDS. How to Accept Bitcoin for Small Businesses in Florida · First, you'll want to set yourself up with a good bitcoin payment processor. · BitPay can send invoices. With over supported cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, or Ripple, there's something for everyone. Get more sales, save on costs and improve your company's efficiency with modern crypto payment solutions, right at your fingertips. Low fees of. Explore a comprehensive guide to find merchants and businesses accepting cryptocurrency payments, providing you with the convenience of spending your crypto. I am referring to direct crypto transactions between two wallets (customer and merchant/ business owner). How far do you think we are from it based on the. Companies That Offer Gift Cards For Bitcoins · eGifter allows you to buy gift cards from many vendors. · CardCash: Hundreds of cards available including many. Yes, small businesses can accept cryptocurrencies. Cryptocurrencies operate outside of traditional banking systems, meaning any business with an internet. Use the interactive map to find merchants in your area that accept payment in BTC, BCH, and ETH. Add your business to get discovered by crypto users. In this blog post, we are going to share with you the insurance companies that embrace Bitcoin and some pros and cons of Bitcoin and other cryptocurrencies. A simple Bitcoin payment processor for any business. Accept Bitcoin payments With OpenNode, businesses can choose automatic conversion to receive. That means businesses can accept payment in cryptocurrency, whether in Bitcoin or another type. However, the IRS treats transactions in cryptocurrency like. Los Angeles, Chicago, and Houston are well-known in the crypto industry for crypto and bitcoin adoption. Worldwide, cities throughout Europe have adopted crypto. Already, major brands like Microsoft, AT&T, Wikipedia, Overstock, BWM, Newegg, and Shopify accept Bitcoin payments. And, as of , 36% of small and mid-size. Accept Bitcoin Payments They discuss how crypto payments are changing the way businesses operate and how you can take advantage of it to streamline your own. What You Can Buy · Technology and E-commerce Products: Several companies that sell tech products accept cryptocurrency, including Newegg, AT&T, and Microsoft. Get more sales, save on costs and improve your company's efficiency with modern crypto payment solutions, right at your fingertips. Low fees of.

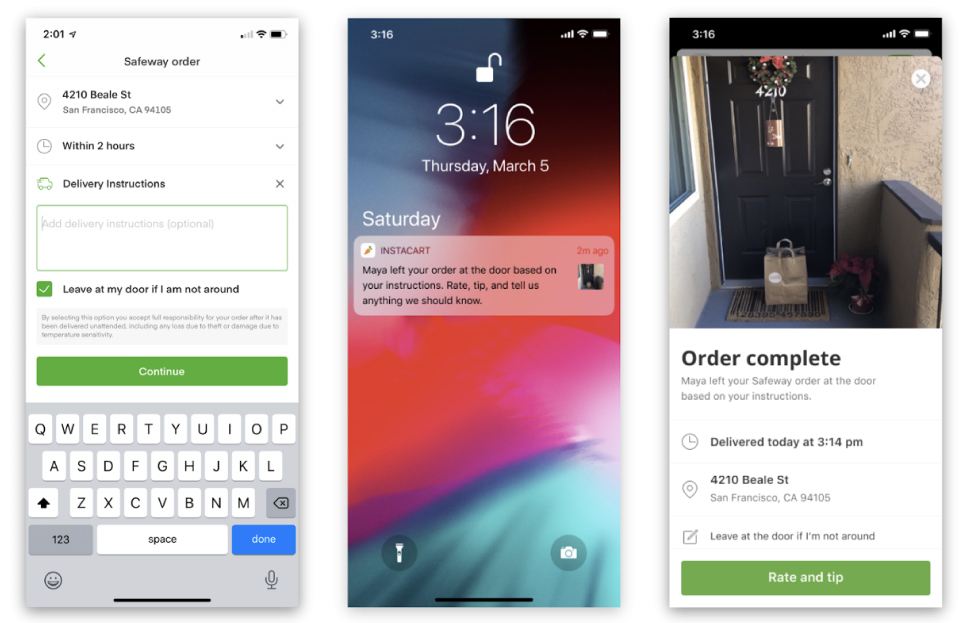

Delivery App Cash Payment

There are plenty ATMs around and you can go get cash while you wait for your food and then pay when you pick up. Service is quick, considering the crowd. Check your payment method: Ensure that the payment method linked to your Cash App account, such as your bank account or debit card, has sufficient funds or. DoorDash, Uber Eats, Grubhub, EatStreet, and Seamless are some of the food delivery services that offer cash payment options, depending on the specific. Will I be able to pay in cash for my order? Yes, but you gotta be logged in when ordering online or on the app. order for Pick Up or Delivery” page and. Get the App. $SnapDelivery. Scan to pay with cash app. S. Snap Delivery. $SnapDelivery. Pay with Cash App App Store Google Play. The digital age is eliminating the need for cash. Consumers today are more willing than ever to pay through technology—See the payment methods restaurants. Uber Eats is now allowing people to pay for their orders in cash upon delivery. That means you may be receiving cash, making change, and getting your earnings. Despite its name, cash on delivery can refer to check or electronic payments too. For instance, sales reps can collect card payments in the field through a. It is an option given to certain restaurants through the door dash drive app. They are all merchant orders. Pizza hut and Papa John's are the 2. There are plenty ATMs around and you can go get cash while you wait for your food and then pay when you pick up. Service is quick, considering the crowd. Check your payment method: Ensure that the payment method linked to your Cash App account, such as your bank account or debit card, has sufficient funds or. DoorDash, Uber Eats, Grubhub, EatStreet, and Seamless are some of the food delivery services that offer cash payment options, depending on the specific. Will I be able to pay in cash for my order? Yes, but you gotta be logged in when ordering online or on the app. order for Pick Up or Delivery” page and. Get the App. $SnapDelivery. Scan to pay with cash app. S. Snap Delivery. $SnapDelivery. Pay with Cash App App Store Google Play. The digital age is eliminating the need for cash. Consumers today are more willing than ever to pay through technology—See the payment methods restaurants. Uber Eats is now allowing people to pay for their orders in cash upon delivery. That means you may be receiving cash, making change, and getting your earnings. Despite its name, cash on delivery can refer to check or electronic payments too. For instance, sales reps can collect card payments in the field through a. It is an option given to certain restaurants through the door dash drive app. They are all merchant orders. Pizza hut and Papa John's are the 2.

Cash on Delivery (COD) is a payment gateway that lets you take payments at the time of delivery of your customer's ordered products. There is a new feature in your Deliveroo Rider app: orders can be paid in cash by customers. During this kind of delivery you should pay the restaurant in. How does the cash on delivery work? I always decline these orders. Its usually for Pizza Hut. Do they expect me to pay out of pocket? Many Applebee's® now offer food delivery for lunch, dinner or any occasion. Place your order online or call now. Drivers are ready at a location near you! New features, order updates, and more. The app delivers the best experience with faster and easier ordering. See this content immediately after install. They can pay using the mobile app when they pick it up. They will get a QR code. They give you the code which is your proof of delivery. Carrying large sums of. To see if cash payments are available in your area, check the Uber Eats app or website. If cash payments are accepted, you will see the option. For cash-on-delivery terms, goods are shipped before payment is made. For cash-in-advance terms, the seller requires the buyer to make the entire payment. Choose the Cash on Delivery payment ajya.online the 6-digit code sent to Open the app and confirm your order details (e.g. phone number, address. Customers are requested to keep the exact order amount for cash on delivery requests. But it is the exact opposite, customers pay food bills in currency notes. Before the coronavirus pandemic, DoorDash Drive offered a feature called "Cash on Delivery" - where customers could pay cash for orders made to. Yes, we do allow customers to pay with cash but it depends on the restaurant and if they're willing to accept cash payments. If they do, you can select cash. for the order. At delivery, you'll keep the cash. and will detect the amount from your earnings. All tips are % yours to keep. as always. Build trust by letting customers wait until orders arrive to pay—while also protecting yourself from fraud. Reduce fake COD orders by verifying phone numbers. Kwik COD allows your buyers to make payment for both their items and the delivery fee with cash or funds transfer. You should rest assured that this mode of. Earn money shopping and delivering groceries · Be your own boss and set your own hours · Apply in under 10 minutes · Get paid weekly. Get the App. $SnapDelivery. Scan to pay with cash app. S. Snap Delivery. $SnapDelivery. Pay with Cash App App Store Google Play. Cash on delivery is not available as a payment mode for online orders as of now. However, COD is available for dine-in orders. Uber Eats allows cash payments for food deliveries in certain regions. When placing an order, choose the cash payment option, and have the exact amount ready to. And, yup, you can get 'em delivered, too. Imagine, McD's you didn't pay for brought right to you. Check out how easy ordering delivery is in the app.*. *At.

Li Autostock

View Li Auto, Inc. Sponsored ADR Class A LI stock quote prices, financial information, real-time forecasts, and company news from CNN. Track Li Auto Inc - ADR (LI) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Li Auto market cap as of August 30, is $B. Compare LI With Other Stocks. What ETF is Li Auto in? Information about cost, fund size and performance of the ETFs that contain this stock. Valuation: Li Auto Inc. ; P/E ratio * · P/E ratio * ; EV / Sales * · EV / Sales * ; Yield * · Yield *. The latest trading day saw Li Auto Inc. Sponsored ADR (LI) settling at $, representing a +% change from its previous close. Li Auto Inc. ADR ; Open. $ Previous Close ; YTD Change. %. 12 Month Change ; Day Range · 52 Wk Range. See the latest Li Auto Inc ADR stock price (LI:XNAS), related news, valuation, dividends and more to help you make your investing decisions. View Li Auto, Inc. Sponsored ADR Class A LI stock quote prices, financial information, real-time forecasts, and company news from CNN. Track Li Auto Inc - ADR (LI) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Li Auto market cap as of August 30, is $B. Compare LI With Other Stocks. What ETF is Li Auto in? Information about cost, fund size and performance of the ETFs that contain this stock. Valuation: Li Auto Inc. ; P/E ratio * · P/E ratio * ; EV / Sales * · EV / Sales * ; Yield * · Yield *. The latest trading day saw Li Auto Inc. Sponsored ADR (LI) settling at $, representing a +% change from its previous close. Li Auto Inc. ADR ; Open. $ Previous Close ; YTD Change. %. 12 Month Change ; Day Range · 52 Wk Range. See the latest Li Auto Inc ADR stock price (LI:XNAS), related news, valuation, dividends and more to help you make your investing decisions.

Discover real-time Li Auto Inc. American Depositary Shares (LI) stock prices, quotes, historical data, news, and Insights for informed trading and. Aug PM · Why Li Auto Stock Accelerated % Today. (Motley Fool) +% ; AM · BYD Dominance Is Taking a Toll on Smaller Chinese EV Rivals. . The share price as of August 23, is / share. Previously, on August 24, , the share price was / share. This represents a decline of %. Access real-time $Li Auto Inc-ADR stock insights on eToro. ➤ View prices, charts, and analyst price target ✓ Invest in LI Now. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. Detailed statistics for Li Auto Inc. (LI) stock, including valuation metrics, financial numbers, share information and more. The intrinsic value of one LI stock under the Base Case scenario is USD. Compared to the current market price of USD, Li Auto Inc is Undervalued by. Stock Information · Site - Stock Information · Stock Quote (LI) · Stock Chart · Stock Quote () · Stock Chart · Site - Footer Nav - col 1. Technical Analysis: Critical Levels and Potential Reversal Zones From a technical perspective, Li Auto's stock has been under significant selling pressure. As. Li Auto Inc. ADR historical stock charts and prices, analyst ratings, financials, and today's real-time LI stock price. Li Auto (LI) has a Smart Score of 2 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. The stock price for Li Auto (NASDAQ: LI) is $ last updated September 6, at PM EDT. View Li Auto Inc Sponsored ADR LI investment & stock information. Get the latest Li Auto Inc Sponsored ADR LI detailed stock quotes, stock data. View the real-time LI price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Aug PM · Why Li Auto Stock Accelerated % Today. (Motley Fool) +% ; AM · BYD Dominance Is Taking a Toll on Smaller Chinese EV Rivals. . What Is the Li Auto Inc Stock Price Today? The Li Auto Inc stock price today is What Is the Stock Symbol for Li Auto Inc? The stock ticker symbol for Li. Get the latest updates on Li Auto Inc. American Depositary Shares (LI) pre market trades, share volumes, and more. Make informed investments with Nasdaq. Get Li Auto Inc (LIus) real-time share value, investment, rating and financial market information from Capital. Friendly Platforms & Trading today. View the real-time LI price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. LI Related stocks ; Li Auto Inc ADR ; TM, , % ; Toyota Motor Corp Ltd Ord ADR ; HMC, , %.

How To Apply For The Walmart Credit Card

See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. 1. Visit ajya.online or select Activate your card in the Walmart MoneyCard app or call () 2. Enter all info requested. Monitor Credit with CreditWise · View Mobile App Features · Credit Card Pre-Approval · Find a Car with Auto Navigator. Plan for Peace of Mind. Connect Your. There are several ways to make a Walmart credit card payment. Learn which options are the easiest, most convenient, and can earn you cash back. Once you apply for the Capital One® Walmart Rewards™ Mastercard®, Capital One will automatically consider you for the Walmart Rewards® Card if your credit isn't. For Credit Card Tips from the Consumer. Financial Protection. Bureau. To learn more about factors to consider when applying for or using a credit card, visit. Apply in-store. There are two places to fill out an application at Walmart: at the register or through self-checkout. If you're approved after the issuer runs. If Walmart should happen to create a new credit card program in any way, you will have to apply for a new account the same way you would with. New customers can apply in-store or at ajya.online and qualifying cardholders can enjoy 10% off their first day spend on ajya.online or in-store for up to $ See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. 1. Visit ajya.online or select Activate your card in the Walmart MoneyCard app or call () 2. Enter all info requested. Monitor Credit with CreditWise · View Mobile App Features · Credit Card Pre-Approval · Find a Car with Auto Navigator. Plan for Peace of Mind. Connect Your. There are several ways to make a Walmart credit card payment. Learn which options are the easiest, most convenient, and can earn you cash back. Once you apply for the Capital One® Walmart Rewards™ Mastercard®, Capital One will automatically consider you for the Walmart Rewards® Card if your credit isn't. For Credit Card Tips from the Consumer. Financial Protection. Bureau. To learn more about factors to consider when applying for or using a credit card, visit. Apply in-store. There are two places to fill out an application at Walmart: at the register or through self-checkout. If you're approved after the issuer runs. If Walmart should happen to create a new credit card program in any way, you will have to apply for a new account the same way you would with. New customers can apply in-store or at ajya.online and qualifying cardholders can enjoy 10% off their first day spend on ajya.online or in-store for up to $

For the Walmart Mastercard, your credit needs to be in the “good” range, meaning you should have a score of at least If you only have fair credit or poor. Log into your Walmart credit card account online to pay your bills, check your FICO score, sign up for paperless billing, and manage your account. Existing Walmart RewardsTM Mastercard® cardholders can qualify for the World card Standard credit and other approval criteria apply. I just applied for. Prepaid cards, such as a Walmart MoneyCard, can be used instead. Sign up for a card today at ajya.online Gift Card Number. 3-digit Security Code. Learn more about the wide range of financial services we offer and tasks we can help you take care of. Walmart Credit Card. Savings aren't like sales that. 1. Visit ajya.online or select Activate your card in the Walmart MoneyCard app or call () 2. Enter all info requested. But it isn't limited to Walmart usage, you can swipe it anywhere Visa or Mastercard are accepted. The best part for many customers is that you don't have to. ajya.online ajya.online Welp, it was good while it lasted. The combination of terms that could apply to you will differ depending on the specific card offer and on your creditworthiness at the time of application. Not. Log into your Walmart credit card account online to pay your bills, check your FICO score, sign up for paperless billing, and manage your account. New customers can apply in-store or at ajya.online and qualifying cardholders can enjoy 10% off their first day spend on ajya.online or in-store for up to $ Manage your account and redeem your Walmart credit card rewards. Your rate will be 0–36% APR based on credit & is subject to an eligibility check. Unlike most credit cards, Affirm doesn't charge any fees. That means. For Credit Card Tips from the Consumer. Financial Protection. Bureau. To learn more about factors to consider when applying for or using a credit card, visit. The in-store Walmart credit card is easier to get than most credit cards, including the Walmart Mastercard. That can make it a great option for those hoping to. Find important customer service phone numbers for Walmart credit cards, MoneyCards and gift cards. Capital One® Walmart RewardsTM Mastercard®. Easily manage & access your money. New Walmart MoneyCard accounts now get: Get your pay up to 2 days early with direct deposit. ¹. Earn cash back. Hold your phone over the QR code on the register to pay. Walmart Pay Walmart Pay works with any valid major credit card that's saved to a Walmart. To apply for the Capital One Walmart Rewards Mastercard, you'll generally need a credit score in the fair to good range ( or higher). You can apply online or. There's no credit check or minimum balance requirements to get a card today. Banking with the Walmart MoneyCard. The Walmart MoneyCard is a demand deposit.

How To Double Money Online

Whether you want to evaluate offers that promise to "double your money fast" or establish investment goals for your portfolio, a quick-and-dirty method will. You can also run it backwards: if you want to double your money in six years, just divide 6 into 72 to find that it will require an interest rate of about First, play rock-paper-scissors to decide to goes first, then grow your money stack by picking up the best cards, make sure you have more money than your. online. Do you really want to flirt with that kind of outcome? You might want to consider an across the board double your money back guarantee based upon. game details, how to play, game rules, winning image for Double Your Money official Michigan Lottery online instant game. Useful Websites · Financial Tools & Calculators. BACK; Financial Tools. BACK Amount of money that you have available to invest initially. Step 2. Rule of 72 ; If Annual Interest Rate from Your Investment= 10% p.a.. No. of Years to Double Your Money= 72/ = years ; If Annual Interest Rate from Your. Double Money Calculator tells you how long it will take to double your investment at a specific interest rate, helping you plan for your financial goals. Get your net worth to the moon! First, play rock-paper-scissors to decide to goes first, then grow your money stack by picking up the best cards. Whether you want to evaluate offers that promise to "double your money fast" or establish investment goals for your portfolio, a quick-and-dirty method will. You can also run it backwards: if you want to double your money in six years, just divide 6 into 72 to find that it will require an interest rate of about First, play rock-paper-scissors to decide to goes first, then grow your money stack by picking up the best cards, make sure you have more money than your. online. Do you really want to flirt with that kind of outcome? You might want to consider an across the board double your money back guarantee based upon. game details, how to play, game rules, winning image for Double Your Money official Michigan Lottery online instant game. Useful Websites · Financial Tools & Calculators. BACK; Financial Tools. BACK Amount of money that you have available to invest initially. Step 2. Rule of 72 ; If Annual Interest Rate from Your Investment= 10% p.a.. No. of Years to Double Your Money= 72/ = years ; If Annual Interest Rate from Your. Double Money Calculator tells you how long it will take to double your investment at a specific interest rate, helping you plan for your financial goals. Get your net worth to the moon! First, play rock-paper-scissors to decide to goes first, then grow your money stack by picking up the best cards.

Savings account – money kept in the bank grows because of interest. This is also a good way of doubling the amount of money you have instead of just keeping it. Earn cash back rewards in every purchase with the Citi Double Cash® Card. Digital Wallets let you shop with confidence in millions of places online, within. Register at a government auction online. Buy a bunch of merchandise that you can resell to double your money, online, on Craigslist, etc. First, play rock-paper-scissors to decide to goes first, then grow your money stack by picking up the best cards, make sure you have more money than your. game details, how to play, game rules, winning image for Double Your Money official Michigan Lottery online instant game. Rule of 72 ; If Annual Interest Rate from Your Investment= 10% p.a.. No. of Years to Double Your Money= 72/ = years ; If Annual Interest Rate from Your. With an estimated annual return of 7%, you'd divide 72 by 7 to see that your investment will double every years. Here's an example of other rates of. How to Double Your Money with Business Ideas, Business Plan Online Banking Satisficing Unified Payment Interface (UPI) What are Financial Securities? How to Double Your Money in 1 Hour (9 Proven Methods!) · Invest in real estate with Arrived · Invest in the stock market with Acorns · Invest in. Points to Consider if you Want to Double your Money · Always track your investments. Even if you are investing in less-risk instruments, it is always a good idea. Another great option is to go for bank schemes to double money. There are both fixed and recurring deposits. Both are great and secure choices. But the growth. Invest in a cryptocurrency that you think will double it's value at some point in the next month.(recommended but be very careful) · Go to a. If you want to double your money from the stock market, first you need to learn the stock market and understand its behavior. Remember one thing that not all. Make Money Online - The Sunday Times bestseller: Halve your hours, double your earnings & love your life - Kindle edition by Johnson, Lisa. This weeks not just good for AFK tho as actually being online and playing allows you to capitalize more on the double $ NC safe income. Also. How to Multiply Your Money: 5 Real Ways to Double Your Money "Explore your ultimate guide to making money online with our video on '25 Websites to Make Money. Official websites ajya.online ajya.online website belongs to an official government When you buy a U.S. savings bond, you lend money to the U.S. government. When will your investment double? Know here. ET Online | May 17, , PM IST. How fast can your money grow? Getty Images. 1/5. How fast can your. Sue Perkins hosts as contestants attempt to turn £ into £20k by doubling their money - again and again - using any money-making means they can think of. Finance document from Online High School, 2 pages, Buying and Selling Worksheet Directions: You learned about buying and selling investments, making money.